U.S. Quantitative Easing programs are usually bullish for precious metals as the currency debasement that results from them forces investors to seek some hedges. A lower US dollar and higher inflation prospects are alarm bells that, on paper, should push gold prices higher. Gold is up more than 10% this year and more than double its values since the FED started with their QE experiment back in 2008 but, as of recently, interest in the metal is now beginning to fade – why is this?

Although being up on the year, gold yesterday hit a one month low just below $1,730 and buying interest has been muted from actual physical gold buyers like the jewellery industry. Is QE3’s gold boosting power waning and is the price of the precious metal now likely to revert to trend?

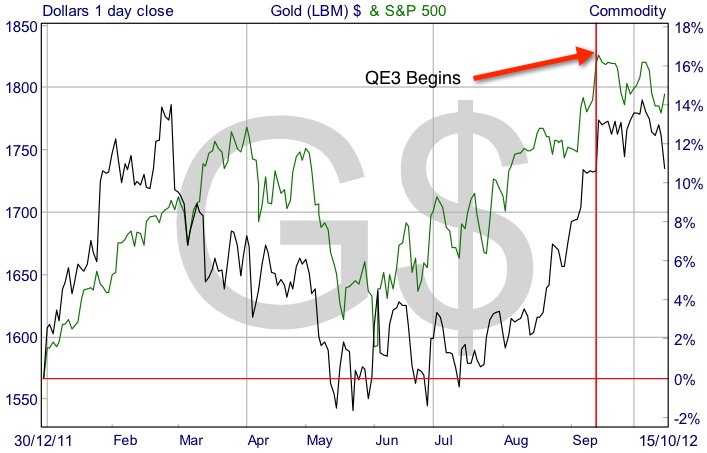

The table below shows the relative performance of gold, the global benchmark equity index S&P 500 and three currency crosses for the USD over various timescales. We can see that it is in the past year in particular that the gold has been losing steam against the S&P 500 in particular and that since the QE3 announcement it has now gone nowhere essentially, giving back all the post announcement ‘pop’.

We can also see from the table that the last few years have been very positive for pretty much all the asset classes with the exception of the euro and sterling. With pretty much globally co-ordinated monetary easing and interest rate cuts it’s not surprising that the higher beta currency plays and riskier assets have all been boosted. Strong demand from China for several raw materials and precious metals has additionally helped the “Aussie” and gold.

As we can see from the table above, so far the effects from the latest QE program have not delivered was what supposed to be in the script for gold and even the Aussie has produced a negative return, although this is linked specifically to the Australian Reserve Banks own interest rate cuts in an attempt to weaken the currency given the slowing export markers and softer commodity prices that has weighed on economic growth there.

The latest economic data out of the US has been pointing to increasing growth momentum with increases in both consumer sentiment and confidence, a drop in initial jobless claims and an improvement in the jobs market – perhaps finally Mr Bernanke’s unconventional policy measures are finally beginning to bear fruit..?

The unemployment rate in the US has decreased substantially from 8.1% to 7.8% in recent months and initial jobless claims dropped to 330,000 – its lowest level in more than four years and symbolically, back to pre-crisis levels. The latest Michigan indicator of consumer sentiment also printed an increase to a level not seen for several years and the housing market is picking up steam for the first time in 5 years. In short, the US economy is gaining traction. Net effect is that investors views on QE3’s duration and scale are being affected, with many commentators expecting the program not to continue beyond 2013 – we can already see this in bond yields and eurodollar interest rate future expectations too. Should the economic momentum continue then Gold is likely to be pressured, particularly given the very heavy bull position in the metal – the support of real physical demand will likely not come in until $1200.

Another headwind for the precious metal is also Chinese physical demand. Imports of Gold from mainland China actually decreased in August, and have been decreasing over the last few months. The country experienced double digit annual growth in gold imports during the last few years as the result of demand from commercial dealers, investment, and jewelry fabrications. As inventory is now also additionally very high and demand weaker, bulls should pay heed of this particular factor too.

Perhaps it’s time to open a short on gold?