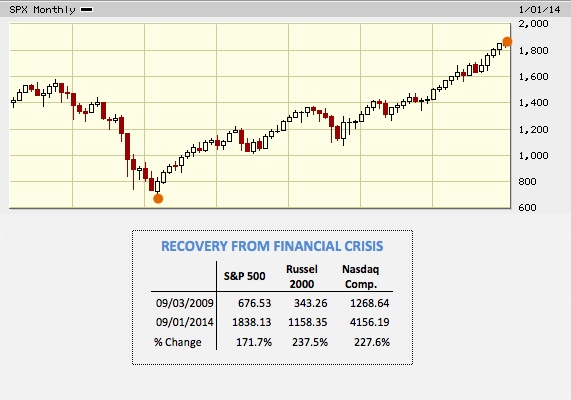

Some five years after global financial markets bottomed, it appears that everything is back on track with US equity indices such as the S&P 500 not only fully recovering their pre-crisis index levels but actually powering on to post new record highs. But, whilst rising financial assets is views as a good indicator for the wealth of the whole economy, there are growing questions of the actual health of the real economy.

To us at SBM, it is a pretty compelling argument that financial assets are currently trading at elevated levels and, more importantly, beyond a justifiable point based upon earnings and the near term economic outlook. The reason behind this divergence lays squarely with the actions of central banks in recent years who have been pushing the price of financial assets ever higher with their money printing activities. In contrast with equity prices, US GDP and its net job creation has been growing at a pace that is much less than in prior post-crisis periods, periods without the large volume of money printing… It seems that the principal effect of the QE programs has been the massive redistribution of wealth from the middle classes to the already very wealthy. Fundamentally this is a disastrous social policy and something must give at some point.

In setting monetary policy, the FED’s dual mandate is to contain inflation whilst attempting to keep the economy running at full employment. As the American economy is actually a consumption-driven one, any measure aimed at driving GDP higher should thus be tailored towards incentivising consumption. The FED believes that the purchase of financial assets to suppress bond yields would be the best policy to create growth. In keeping interest rates low this helps with mortgage payments for example – one of the biggest after tax expenditures of great swathes of any country’s populace; credit creation (and so wider economic activity) and, supposedly as a final benefit but not a principal one, lead eventually to higher financial asset prices which results in a “feel good” factor. Collectively this would all increase further household wealth and thus consumption and so GDP. Sounds like a great plan eh?!

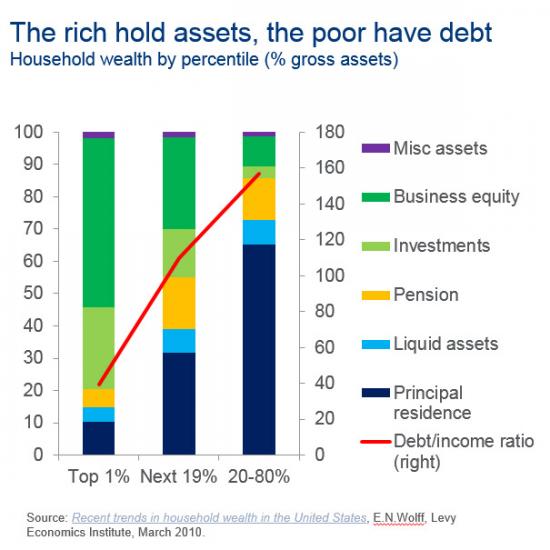

While theoretically reflating asset prices seems a good base economic policy after a debt crunch, in practice it may not be the case as financial assets aren’t distributed equally across the population. Just take a look at the following table

The rich hold much more of their wealth in financial assets as opposed to say bricks and mortar. The top 1% holds more than 50% of their wealth in investments and business equity while these items represent just a tiny part of the typical poor person’s wealth, if any. Just think about it. If you had to feed your family, where would you start? Would you go first to the supermarket or to see your local investment banker? Good luck on the latter!

“Yellanke” – the modern day ‘reverse’ Robin Hood?

Nearly two thirds of the American population’s primary net wealth is tied to their living residence. It is the most important asset they will typically ever own. Next is their pensions (generally 401K’s) and ultimately “miscellaneous” assets with peripheral equity holdings last. The vast majority of US citizens are indebted, holding several credit lines to pay for their homes and in fact for many, day to day living expenses. With this in mind then we can see that it is relatively straightforward to realise that when equity prices rise, the first to benefit from it are the top 1% depicted in the table, those who own business equity and financial investments. So, when conducting the current monetary policy, mainly consisting of buying assets to drive equity prices higher, the FED is actually redistributing wealth on a very large scale (trillions of dollars) or, at the very least, delivering the very wealthy further windfall gains on their equity holdings. In effect, Mr Bernanke, Ms Yellen et al are adding to the substantial pile held by the world’s elite. While we are far from socialists here at SBM, we fail to see how this is in the best interests of the population as a majority.

Incredibly, policy makers will still tell you that they expect indirect effects deriving from QE to ultimately disseminate out to the poor. So the script goes, if the richest benefit the most then on the second stage their spending will ripple out into the wider economy in a trickle-down effect creating jobs who in turn will spend their extra dollars and so help the economy grow. Problem is 5 years into this experiment and seemingly learning nothing from Japan’s 1990’s QE programs, this isn’t happening. All that is occurring is ever more “luxury goods” bubbles like London & NY real estate, art, fine wine etc as “Mammon” and his brother compete further to consume are being created. How does this “pass the parcel” between the top 1% trickle down to help Main St or Mrs Smith in the provinces? In short it doesn’t and it hasn’t.

One of the most important concepts in economics is what is called the marginal propensity to consume. This metric tells you how much a particular group, or the entire population, is expected to spend in consumption for each $1 they get in income. The higher this rate is, the more that is spent on consumption. If we think a little about it, we can likely understand how different such a measure is for the richer than for the poor or, say for the top 1% relative to the rest of the population. If your disposable income at the end of the month were £50,000 then you would probably spend £10,000 or £20,000 and save the remainder to buy property, invest, or to keep as emergency funds. That means your marginal propensity to consume is 0.2 or 0.4, at most. But now imagine you’re not as lucky and come home with just £500 at the end of the month. How much will you keep as emergency funds, or invest? Absolutely nothing. You will spend every penny in your pocket and that would probably not be enough. Your marginal propensity to consume is therefore 1.0. Effectively, as your income rises, the ratio falls.

Bearing this in mind, then whom should we target if we want to stimulate GDP growth?

Recall that the American economy is 90% consumption-driven. As the rich have a much lower marginal propensity to consume then any policy should therefore never be aimed at enhancing the wealth of the richest. On this basis alone there is and has been no justification for the current QE policy. The policy was and always has been about reflating the bank’s balance sheets from complete collapse due to the mass of underperforming loans and bad investments made in the bubble years. Yes of course without the QE policies the global economy probably would have endured a depression for many years, akin to what Japan has suffered since its own implosion in the early 90’s but the ‘medicine’ has now become toxic. The QE policies have simply taken from the masses and given to the extreme minority. In places like Southern Europe that have had extreme austerity inflicted upon them it is gobsmacking to us that there has not been a real social revolution.

Another issue that has resulted from QE is that it erodes the purchasing power of the US dollar. Why? Simple supply/demand rules. In printing more dollars, the FED is increasing the relative supply of dollars. For the market to absorb that extra quantity, the price for the dollar must thus decrease. It means that the price of the dollar relative to any other asset drops, and that is the same as saying that the purchasing power of the dollar declines. If that happens, then consumers will have to either take on additional debt to keep their living standards or, ironically, to reduce consumption. Another redistribution of wealth and negative effect on GDP derives from this and is actually the polar opposite of what QE is supposed to achieve!

So, it is clear that quantitative easing is not favourable for the poor but it is great for the rich. Take a look below at what has happened to the equity market since 2009 and mix the information with the figure showing wealth configurations.

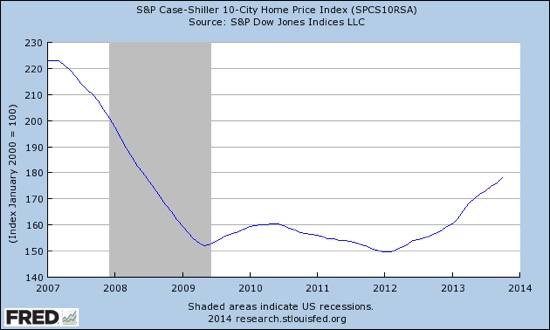

The S&P 500 rose 171%, the Nasdaq rose 228% and the Russell 2000 exploded 238%. For those who own more than 50% of their wealth in business equity, the last five years have probably been the best in recent memory. For the rest of the population who are still paying for their homes the primary benefit is that many kept their jobs when otherwise they would not have as “zombie” business and the like would have been shut down to collect whatever cents on the dollar the debt holders could. This aside, if you look at the chart below you will understand how modest these gains have really been when compared with equity gains.

The S&P Case-Shiller records home prices for 10 American cities. As can be seen, and unlike what happened in the equity market, home prices have not recovered their prior peak. Recall that the majority of the populace’s wealth is tied up in their homes. Again, they have fallen behind relative to the rich. Whilst equity markets started their recovery in 2009, home prices continued to drop for almost an extra three years and the gains are still very mild.

In an article we published last Monday (https://www.spreadbetmagazine.com/blog/worlds-billionaires-now-hold-33-trillion-in-net-wealth.html) we revealed the fact that the 300 individuals who comprise part of the Bloomberg Billionaires Index collectively increased their wealth by 16.5% in 2013. If you divide this value by the S&P 500 gains for 2013, which were 29.6%, you obtain a proportion of 55.7%, which is in line with the first chart we show here relating to the proportion of business equity for the top 1%. These people are getting pretty much all the benefits deriving from the Fed’s current monetary policy.

It is now an unarguable fact that QE has not increased the consumption of the population en bloc but that it has resulted in one of the greatest wealth redistributions ever. The richest are getting richer, and at the cost of the hard working middle class, the poor and also future generations. There will be real social fall out as an after effect of this in years to come and we leave you with one final re-iteration of the point made above – “It means that the price of the dollar relative to any other asset drops, and that is the same as saying that the purchasing power of the dollar declines”. The one asset that has increased at a much lower rate than other assets is the supposed “barbarous relic” gold as we can see from the chart below.

Bear in mind that the increase in supply of gold is minimal each year too. Whilst the S&P 500 has nearly tripled since the onset of the first QE program, gold is up by less than 50%. That’s right, an inelastic good has risen by a fraction of an elastic asset – equities (where equity can and has been issued in recent years as people cash out with their paper money values).