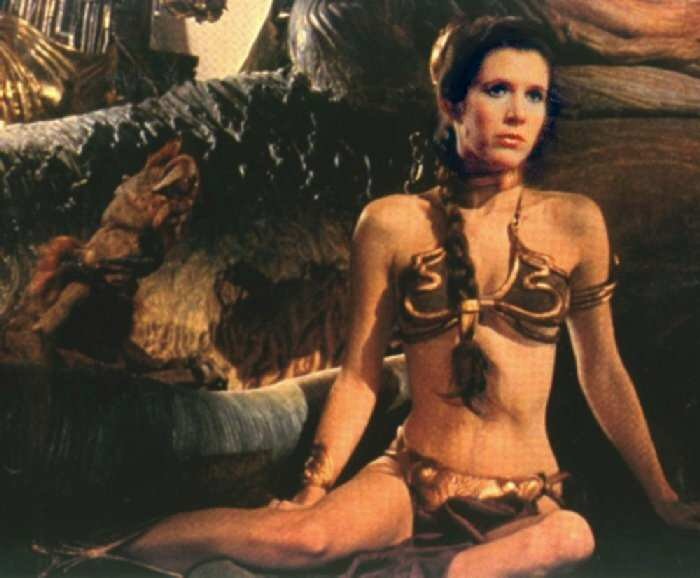

I seem to remember that there used to be an AIM Australia Day party. The “cesspit” meets a bunch of folks from a country which started its colonial life as a penal colony. It sounds like a hoot. But I guess that I am not going to get invited if such an event still takes place. Or perhaps it never did and was just a figment of my imagination – a sort of party for white collar folk held in Jabba the Hut’s Bar. Did Princess Leia attend this party? Which PR firm does she work for as I’d like a briefing? And which dodgy mining stock is Jabba promoting today? We need to know.

I slightly digress, but I am a Star Wars groupie and Carrie Fisher is always welcome at Chez Winnifrith to pop on over and drone on yet again about her celeb parents and all that cocaine she took any time. Now,where was I? Oh yes, in that water and snake filled garbage crusher on the Death Star when Luke, Han, Chewie and Leia almost get crushed before R2D2 and C3PO save them by hacking into the control system. I refer of course to AIM.

It seems that barely a day goes by without me feeling compelled to vent my anger about some outrage inflicted on investors on the cesspit. But, it strikes me that a disproportionate number of the stocks that I write about in this vein, are dual listed on the ASX and are primarily Australian companies. Over on www.Shareprophets.com in the past week I have let rip on Range Resources (still a sell), ScotGold (still a sell) and Norseman Gold (unable to sell as it has been booted off the cesspit). And there are others to follow. I make a few general observations.

Good quality resource stocks based in the former penal colony can easily raise cash from Australian investors. They therefore have no need to take on the additional regulatory or financial burden of a dual listing in London on the cesspit. Therefore almost by definition those companies that come to London to tap up mug punters (institutional and retail) in the UK are “less good” enterprises.

Of course the City loves them. Not only do advisors get to rack up big fees for arranging the dual listing but it is another retainer to pay the monthly payroll and there are bound to be fund-raisings where the commission is 5%. Bonuses, champagne and cocaine all round! Who cares about the quality (this is the AIM cesspit after all)? Just show me the money!

Hitherto retail punters have been encouraged to buy these shares because under the old ISA rules dual listed AIM stocks were ISA-able in a way that normal AIM stocks were not. That has now changed but it goes to show “never make a bad investment to get a good tax break.”

But, with the ISA hook removed, I wonder how long this dual listing bandwagon can continue to roll? When is the next dual listed disaster going to emerge? I suspect, given the fact that most dual listed stocks are in the Jimmy Savile sectors of mining and oil (no-one likes them any more and for good reasons) we will not have to wait long. ..

Meanwhile, with the odd notable exception (Leyshon), my general rule is that dual listed stocks are an across the board sell.